Quick Cash with Payday Loans from eLoanWarehouse

You know that moment when an unexpected expense hits you out of nowhere? I’ve been there, scrambling to figure out how to cover an urgent bill or unexpected car repair. It’s stressful, to say the least. That’s when I started exploring quick cash solutions, and I came across payday loans. They’re often the first thing that comes to mind when you need money fast. But before you dive into getting one, it’s essential to understand what you’re getting into.

So, let’s talk about payday loans and, more specifically, eLoanWarehouse. This is a platform many turn to when they’re in a pinch. But should you? In this article, I’ll walk you through everything you need to know about payday loans from eLoanWarehouse, based on what I’ve seen and experienced. By the end, you’ll have a clearer picture of whether this is the right option for you when you’re in a tight spot.

What Are Payday Loans?

Payday loans are pretty straightforward, but they can be a bit tricky if you’re not familiar with how they work. Essentially, a payday loan is a short-term loan designed to help you cover immediate expenses until your next paycheck. The idea is simple: you borrow a small amount of money, usually up to a few hundred dollars, and then pay it back when you get paid, typically within a couple of weeks.

I remember the first time I came across payday loans. I needed some quick cash to cover a medical bill that I hadn’t planned for. The whole process was fast, and before I knew it, I had the money in my account. However, I quickly realized that while payday loans offer quick relief, they also come with a set of terms that you need to be fully aware of before diving in.

How Payday Loans Work?

Here’s the basic idea: You apply for a payday loan, either online or at a physical location, and if approved, the lender gives you the cash, often within 24 hours. The catch? You’re expected to pay it back by your next payday, along with any interest and fees. If you don’t pay it back on time, things can get messy—extra fees, higher interest rates, and in some cases, it might even hurt your credit score.

Payday loans are meant to be short-term solutions, not long-term fixes. They’re helpful in a pinch, but you should only use them if you’re sure you can pay back the loan quickly. Otherwise, the costs can pile up faster than you might expect.

When to Consider a Payday Loan?

There are definitely situations where a payday loan can be a lifesaver. I’ve seen people use them to cover emergency car repairs, unexpected medical bills, or even just to keep the lights on until payday. But here’s the thing—payday loans should be your last resort. If you have other options, like borrowing from a friend or adjusting your budget, try those first. Payday loans are there when you really need them, but they’re not without their risks.

Why Choose eLoanWarehouse?

When I first started exploring payday loan options, eLoanWarehouse quickly stood out to me. The name kept popping up in my searches, so I decided to dig a little deeper. What I found was a platform that offers some distinct advantages over other payday loan providers. But like with anything, it’s important to know why you might choose one service over another.

Fast and Easy Application Process

One of the things that caught my attention with eLoanWarehouse is how simple they make the application process. The first time I applied, I was honestly surprised by how quickly it all moved. You start by filling out an online form, which asks for some basic information like your name, address, and income details. It’s nothing too complicated, and it took me just a few minutes to complete.

What happens next is where eLoanWarehouse really shines. After submitting the application, I got a response almost instantly. The quick turnaround was a relief, especially when you’re in a situation where time is of the essence. In my case, the funds were deposited into my account the very next day, which was exactly what I needed.

Quick Approval and Fund Disbursement

Another big plus for eLoanWarehouse is how fast they move. I’ve dealt with other lenders in the past where the approval process felt like it dragged on forever. But with eLoanWarehouse, everything was streamlined. After filling out the application, you typically receive an approval decision right away, and the money can hit your bank account in as little as one business day.

This speed is crucial when you’re dealing with an emergency. I remember needing to cover an unexpected medical bill, and the quick access to funds from eLoanWarehouse made all the difference. It’s reassuring to know that in those moments when you need cash fast, there’s a service out there that can deliver without a lot of red tape.

No Credit Check Required

One of the reasons I initially hesitated about applying for payday loans was the concern about my credit score. Let’s face it—many of us don’t have perfect credit, and the last thing you want is a hard inquiry that could ding your score further. That’s where eLoanWarehouse stands out. They don’t require a credit check, which makes the loan accessible even if your credit history isn’t spotless.

This was a game-changer for me. Knowing that I could get the cash I needed without worrying about a credit check made the decision to apply much easier. For anyone in a similar situation, this feature alone might make eLoanWarehouse the better option compared to other payday lenders.

Transparent Terms and Conditions

I’ve come across plenty of lenders who bury their fees and terms in fine print, making it hard to know exactly what you’re signing up for. But with eLoanWarehouse, I found their terms to be pretty clear and straightforward. Everything is laid out upfront, so you know what to expect in terms of interest rates, fees, and repayment schedules.

This transparency was refreshing. It gave me confidence that I wasn’t walking into a trap with hidden costs that would catch me off guard later. It’s one of the reasons I felt comfortable using their service, and why I’d consider using them again if the need arises.

Accessible and Convenient

Finally, eLoanWarehouse’s online platform is incredibly user-friendly. Whether you’re applying from your computer or on your phone, the entire process is smooth and hassle-free. I’ve found that this convenience is a big selling point, especially when compared to traditional lenders who might require you to visit a branch or fill out piles of paperwork.

Overall, the combination of a fast application process, quick fund disbursement, no credit check, and clear terms make eLoanWarehouse a solid choice if you’re considering a payday loan. But remember, it’s always important to borrow responsibly and only take out a loan if you’re confident you can repay it on time.

Eligibility Requirements

Now, before you get too excited about applying for a payday loan with eLoanWarehouse, it’s crucial to make sure you actually qualify. I remember the first time I applied for a loan, I didn’t realize there were specific criteria I needed to meet. Fortunately, eLoanWarehouse makes it pretty easy to know if you’re eligible.

Basic Criteria

To get started with eLoanWarehouse, you need to meet a few basic requirements. First off, you’ve got to be at least 18 years old. That’s a standard rule across most lenders, and it’s no different here. You also need to be a U.S. citizen or a legal resident. This is important because the loan terms and legal protections are based on U.S. laws, so being a resident is a must.

Income Requirement

Next, they require you to have a minimum monthly income of $1,000. This can come from a job, self-employment, or even benefits like Social Security or disability payments. I found this requirement to be pretty reasonable, especially since they’re not asking for a massive income. They just want to make sure you have some way to pay back the loan. When I applied, I had to provide proof of income, which was as simple as uploading a recent pay stub or bank statement.

Bank Account Requirement

You’ll also need an active checking account in your name. This is where things get serious because the funds from eLoanWarehouse are deposited directly into your account, and they’ll also set up automatic repayments from the same account. It’s a straightforward process, but it does mean you need to have a bank account that’s in good standing. I’ve seen people get tripped up here, so make sure your account is ready to go before you apply.

No Credit Check, But Be Cautious

One of the things that drew me to eLoanWarehouse was the fact that they don’t require a credit check. This was a huge relief because my credit score wasn’t exactly stellar at the time. However, just because they don’t check your credit doesn’t mean you’re guaranteed approval. They’ll still review your application based on other factors like your income and bank account history.

When I applied, I didn’t have to worry about a hard inquiry affecting my credit score, which was a big plus. But keep in mind, just because they don’t do a credit check doesn’t mean you should borrow irresponsibly. It’s still important to make sure you can repay the loan on time to avoid any additional fees or complications.

What If You Don’t Meet the Criteria?

If you don’t meet these requirements, don’t stress too much—there are other options out there. I’ve explored a few alternatives myself, like borrowing from friends or family, or even looking into different types of loans that might be more suited to your situation. eLoanWarehouse is a great option if you fit their criteria, but it’s not the only one available.

Final Thoughts on Eligibility

Overall, the eligibility requirements for eLoanWarehouse are pretty straightforward. If you’re over 18, have a steady income, and an active checking account, you’re likely to qualify. And while the lack of a credit check is appealing, it’s still important to borrow responsibly. Only apply if you’re confident you can meet the repayment terms, because getting stuck in a cycle of debt is something you definitely want to avoid.

Loan Amounts and Repayment Terms

When I was first looking into payday loans, one of my main concerns was how much I could actually borrow and how the repayment would work. eLoanWarehouse offers a range of loan amounts and repayment terms, which gives you some flexibility depending on your needs and financial situation. But, as with anything involving money, it’s essential to understand the details before diving in.

Available Loan Amounts

eLoanWarehouse provides loans ranging from $300 to $3,000. The exact amount you qualify for depends on a few factors, such as your income and whether you’re a new or returning customer. I remember when I applied for the first time, I was a bit nervous about how much I’d get approved for, but the process was pretty straightforward.

If you’re new to eLoanWarehouse, don’t expect to get the maximum amount right away. They tend to be a bit more conservative with first-time borrowers, which honestly makes sense. After all, they’re taking a risk by lending money without a credit check. However, as you build a relationship with them—meaning you take out loans and repay them on time—you might qualify for higher amounts in the future.

Repayment Period

The repayment terms with eLoanWarehouse are relatively short, typically tied to your next payday. This usually means you’ll need to repay the loan within two weeks to a month. When I took out my first loan, I knew I had to be disciplined about paying it back on time because the last thing I wanted was to be stuck paying late fees or rolling the loan over, which can quickly lead to a cycle of debt.

If you’re someone who gets paid bi-weekly, this might mean paying the loan back in one lump sum when your next paycheck arrives. For those who get paid monthly, the repayment might be scheduled to come out of your account automatically on your payday. It’s convenient but also something you need to plan for carefully.

Flexible Repayment Options

One thing that I appreciated about eLoanWarehouse was their flexibility when it came to repayment. They allow you to repay the loan early without any penalties. I took advantage of this when I had a little extra cash before my due date, and it felt good to know I wasn’t going to be penalized for paying ahead of time.

For those who might struggle to repay the full amount on the due date, it’s essential to reach out to eLoanWarehouse as soon as possible. While payday loans are designed to be short-term solutions, the company may offer some options to help you avoid late fees or the dreaded rollover that can make the loan even more expensive.

The Costs of Borrowing

It’s crucial to be aware of the costs associated with payday loans from eLoanWarehouse. While they don’t hide their fees, you’ll want to be fully informed before agreeing to the terms. The interest rates on payday loans are significantly higher than traditional loans, and the total amount you repay will be more than what you borrowed.

When I took out my loan, I made sure to calculate exactly how much I’d be paying back, including all the fees. It’s easy to overlook these details when you’re focused on getting the cash quickly, but trust me, you don’t want any surprises when it’s time to repay.

Why Loan Amount and Repayment Terms Matter?

The loan amount and repayment terms are critical factors in deciding whether a payday loan from eLoanWarehouse is right for you. It’s not just about getting the money you need quickly; it’s also about making sure you can pay it back without putting yourself in a worse financial situation.

I learned that it’s better to borrow only what you absolutely need and to have a clear plan for repayment. This way, you can avoid the pitfalls that many people fall into with payday loans. If you’re careful and responsible, a payday loan from eLoanWarehouse can be a helpful tool in managing short-term financial needs.

Benefits of Choosing eLoanWarehouse

When I first stumbled upon eLoanWarehouse, I was skeptical—after all, payday loans have a bit of a reputation. But after diving in, I found some clear benefits that set eLoanWarehouse apart from other lenders. These perks might not make payday loans perfect, but they do make eLoanWarehouse a more attractive option if you’re in a pinch.

Convenience at Your Fingertips

One of the biggest advantages of using eLoanWarehouse is the convenience. The entire process, from application to receiving funds, can be done online. You don’t have to leave your house, which is a big deal when you’re already stressed about finances. I remember being relieved that I didn’t have to go to a physical location, fill out piles of paperwork, or wait in line. Everything was handled quickly through their website, which saved me time and hassle.

Another thing I appreciated was how easy it was to use their platform. The website is straightforward, and I didn’t have to jump through hoops to figure out where to go or what to do next. For someone who isn’t particularly tech-savvy, this was a big plus. The instructions were clear, and I felt confident throughout the process.

Speed When You Need It Most

Time is of the essence when you’re dealing with an emergency, and this is where eLoanWarehouse really shines. The speed at which they process applications and disburse funds is impressive. After submitting my application, I received an approval almost instantly. The funds were in my bank account the next day.

This kind of speed can be a lifesaver. I once had an unexpected car repair that couldn’t wait, and the quick access to cash from eLoanWarehouse meant I could get my car fixed right away without any delays. When you’re in a tight spot, knowing that you can get the money you need within 24 hours is a huge relief.

No Credit Check Required

One of the most intimidating parts of applying for a loan is worrying about your credit score. I’ve had my share of credit issues in the past, so I was relieved to find out that eLoanWarehouse doesn’t require a credit check. This makes their loans accessible to a broader range of people, especially those who might have been turned down by other lenders.

But, and this is important, just because they don’t check your credit doesn’t mean you should be reckless. The responsibility to repay the loan still falls on you, and if you can’t pay it back on time, you’ll face the consequences—like fees and potentially making your financial situation worse. So while the lack of a credit check is a nice feature, it’s not a free pass to borrow beyond your means.

Transparent and Clear Terms

I’ve come across lenders who hide fees and terms in the fine print, making it easy to get caught off guard by unexpected charges. But eLoanWarehouse is different. Their terms are laid out clearly from the start. You know exactly what you’re getting into, which is crucial when you’re dealing with money.

When I reviewed their terms, I didn’t find any hidden surprises. The interest rates, fees, and repayment schedule were all spelled out in plain language. This level of transparency is rare in the payday loan industry, and it gave me confidence that I wasn’t being taken advantage of. It’s a big reason why I felt comfortable moving forward with my loan.

Early Repayment Without Penalties

One feature that really stood out to me was the ability to repay the loan early without any penalties. I’ve heard horror stories from friends who were charged extra fees for paying off loans ahead of schedule, which seems completely backward. But with eLoanWarehouse, you can pay off your loan early if you have the means to do so, and you won’t be hit with any additional charges.

This was a big relief for me. When I had a bit of extra money before my due date, I paid off my loan early and saved myself some interest. It’s a small thing, but it made a big difference in my overall experience with them. Knowing that I had the flexibility to repay early without penalty was a comforting option.

Solid Customer Support

Finally, I have to mention their customer support. I didn’t need to use it often, but when I did have a question, I found their team to be responsive and helpful. I reached out once with a question about my repayment schedule, and they got back to me quickly with a clear and concise answer. It’s reassuring to know that if something does go wrong, there’s a team ready to help you out.

Why These Benefits Matter?

Choosing a payday loan provider is a big decision, and it’s not one you should take lightly. The benefits offered by eLoanWarehouse—like convenience, speed, no credit check, transparency, early repayment options, and solid customer support—make them a strong contender if you’re considering a payday loan. But remember, these benefits are only valuable if you use them responsibly. Payday loans can be a useful tool, but they’re not without risks.

For me, the decision to go with eLoanWarehouse came down to trust. Their transparent terms and straightforward process made me feel like I was in control of my financial situation, even when things were tight. If you’re in a similar spot, these benefits might make eLoanWarehouse a good fit for you too.

Risks and Considerations

As much as I’ve highlighted the benefits of eLoanWarehouse, it’s crucial to understand that payday loans come with their share of risks. I’ve seen too many people fall into traps because they didn’t fully grasp what they were getting into. So, before you decide to go this route, let’s talk about some of the potential downsides.

High Interest Rates

One of the first things I noticed when I got my payday loan was the interest rate. Payday loans are notorious for having high interest rates, and eLoanWarehouse is no exception. While they don’t hide this fact, it’s something you need to be very aware of. The interest can add up quickly, turning what seemed like a small loan into a much larger debt if you’re not careful.

When I first saw the interest rate, I did a double-take. It was much higher than what you’d find with a traditional loan or a credit card. This is the price you pay for the convenience and speed of getting cash quickly. If you’re not able to pay off the loan on time, the interest can pile up, making it even harder to get out of debt.

Risk of Debt Cycle

This brings me to one of the biggest risks with payday loans: the debt cycle. I’ve heard countless stories from people who took out a payday loan, couldn’t pay it back on time, and ended up taking out another loan to cover the first one. It’s a vicious cycle that can be incredibly hard to break free from.

I was very careful to avoid this trap. I made sure to borrow only what I absolutely needed and had a solid plan for repayment. But not everyone is so lucky. If you’re living paycheck to paycheck, it can be tempting to keep borrowing just to make ends meet. However, this can lead to a spiral of debt that’s hard to escape.

Short Repayment Terms

Another challenge with payday loans is the short repayment term. Typically, you’re required to pay back the loan by your next payday, which could be just a couple of weeks away. This doesn’t give you much time to gather the funds needed to repay the loan, especially if you’re already strapped for cash.

I found this to be one of the more stressful aspects of taking out a payday loan. The clock starts ticking as soon as you get the money, and if you’re not prepared, it can be a real struggle to repay the loan on time. If you miss the due date, you could face late fees, and the interest might start to pile up even more.

Potential for Extra Fees

Speaking of fees, it’s essential to know that missing a payment or rolling over a loan can lead to extra charges. eLoanWarehouse is transparent about their fees, but it’s easy to overlook the details when you’re in a hurry to get cash. Before you know it, those fees can add up, making the loan much more expensive than you initially thought.

I’ve always been careful to read the fine print, but I know that’s not everyone’s strong suit. If you’re considering a payday loan, take the time to understand all the potential costs involved. Ask questions if anything isn’t clear—better to know upfront than to be surprised later.

Predatory Practices

Lastly, while I found eLoanWarehouse to be fair in their dealings, it’s important to recognize that not all payday lenders operate ethically. Some engage in predatory practices, trapping borrowers in a cycle of debt with exorbitant fees and interest rates. These lenders rely on borrowers’ desperation and lack of options to profit at their expense.

I was lucky enough to find a lender that was transparent and straightforward, but I’m aware that this isn’t always the case. If you’re considering a payday loan, do your research. Make sure the lender is reputable and has a track record of fair practices. The last thing you want is to fall victim to a predatory lender who takes advantage of your situation.

Tips for Responsible Borrowing

Given these risks, it’s essential to approach payday loans with caution. Here are a few tips I’ve found helpful:

- Only borrow what you can afford to repay: This might seem obvious, but it’s easy to get caught up in the moment and borrow more than you need. Stick to the minimum amount necessary to cover your immediate expenses.

- Have a repayment plan in place: Before you take out the loan, make sure you have a clear plan for how you’ll repay it. This includes setting aside the money you’ll need to pay off the loan when it’s due.

- Avoid rolling over the loan: If you can’t repay the loan on time, don’t just roll it over. This will only increase the amount you owe and make it harder to pay off in the long run.

- Consider alternatives: Payday loans should be a last resort. If you have other options, like borrowing from friends or family, using a credit card, or negotiating a payment plan with your creditors, explore those first.

Why Understanding These Risks Is Important?

Taking out a payday loan from eLoanWarehouse can be a helpful short-term solution, but it’s not without its risks. By understanding the potential downsides—like high interest rates, short repayment terms, and the risk of falling into a debt cycle—you can make a more informed decision.

For me, being aware of these risks helped me use payday loans responsibly. I made sure to borrow only what I needed and had a clear plan for repayment. If you do the same, you can avoid the common pitfalls that many people encounter with payday loans.

Alternatives to Payday Loans

While payday loans, like those offered by eLoanWarehouse, can be a quick fix when you’re in a bind, they aren’t always the best option. I’ve personally explored a few alternatives that might be worth considering, especially if you’re looking for a solution that doesn’t involve such high interest rates or the risk of getting trapped in a cycle of debt. Here are some options that could work better depending on your situation.

Personal Loans from a Bank or Credit Union

If you have a decent credit score, one of the first places you might want to consider is your local bank or credit union. Personal loans from these institutions typically come with much lower interest rates compared to payday loans. The repayment terms are usually more flexible as well, which can make managing your debt easier.

I once needed to cover an unexpected home repair and decided to go through my credit union. The process took a bit longer than a payday loan, but the lower interest rate and more manageable repayment plan made it worth the wait. Plus, the personal service from my credit union gave me peace of mind.

Borrowing from Friends or Family

Another alternative that I’ve personally leaned on is borrowing from friends or family. I know this isn’t always an option for everyone, but if you have someone in your life who can lend you the money, it’s worth considering. The terms are usually more flexible, and you won’t have to deal with the high interest rates that come with payday loans.

That said, borrowing from people you know can strain relationships if things go south. I’ve always made sure to set clear terms and pay back the money as quickly as possible to avoid any awkwardness. If you take this route, communication is key to maintaining a healthy relationship.

Using a Credit Card

If you have a credit card with available credit, this can be a more affordable option than a payday loan. Credit cards typically have lower interest rates, especially if you can pay off the balance quickly. Plus, some credit cards offer a grace period, allowing you to avoid interest charges if you repay the balance before the due date.

I’ve used my credit card to cover unexpected expenses a few times, and while it’s not my favorite option (because of the temptation to overspend), it’s definitely less costly than a payday loan. Just be sure to keep an eye on your spending and avoid carrying a balance for too long, as the interest can add up over time.

Emergency Assistance Programs

Many communities offer emergency assistance programs that can provide temporary financial help. These programs might help with rent, utilities, or other essential expenses, depending on your situation. While these aren’t always widely advertised, a quick search or a call to your local community services office can point you in the right direction.

I haven’t personally used this option, but I know people who have, and it’s been a lifesaver for them. These programs are often based on need, so if you qualify, it’s worth looking into.

Negotiating with Creditors

If you’re facing a specific financial challenge, like a large bill that you can’t pay off in one go, another option is to negotiate directly with your creditors. Many companies are willing to work with you if you explain your situation and ask for a payment plan. This can give you the flexibility to pay off your debt over time without the need for a high-interest loan.

I’ve done this with a medical bill before, and while it took some time to work out the details, the end result was much more manageable than taking out a payday loan. It’s a good reminder that many creditors would rather work with you than send your account to collections, so don’t hesitate to ask for help.

Why Consider Alternatives?

The main reason to consider alternatives to payday loans is the potential cost and risk involved with payday loans. While eLoanWarehouse is a reliable option within the payday loan market, it’s still a payday loan—meaning it comes with high interest rates and short repayment terms that can make it difficult to manage if you’re not careful.

For me, exploring these alternatives has provided more sustainable options when I’ve needed financial help. They might take a bit more effort to secure, but the long-term benefits—like lower interest rates, better repayment terms, and less risk of falling into debt—make them worth considering.

Choosing the Right Option for You

In the end, the best choice depends on your specific situation. If you need money quickly and have no other options, a payday loan from eLoanWarehouse might be the right call. But if you can take a bit of extra time to explore alternatives, you might find a solution that’s easier on your wallet and less risky in the long run.

Whenever I’ve faced a financial crunch, I’ve learned that it’s always worth taking a step back and considering all the options available. By weighing the pros and cons of each, I’ve been able to make decisions that help me manage my money better and avoid unnecessary stress.

How to Apply for a Payday Loan with eLoanWarehouse?

Applying for a payday loan with eLoanWarehouse is surprisingly straightforward, and having gone through the process myself, I can vouch for how quick and easy it is. If you’re in need of fast cash, understanding how to navigate the application process is crucial. Here’s a step-by-step guide based on my own experience, which should make things a bit smoother for you.

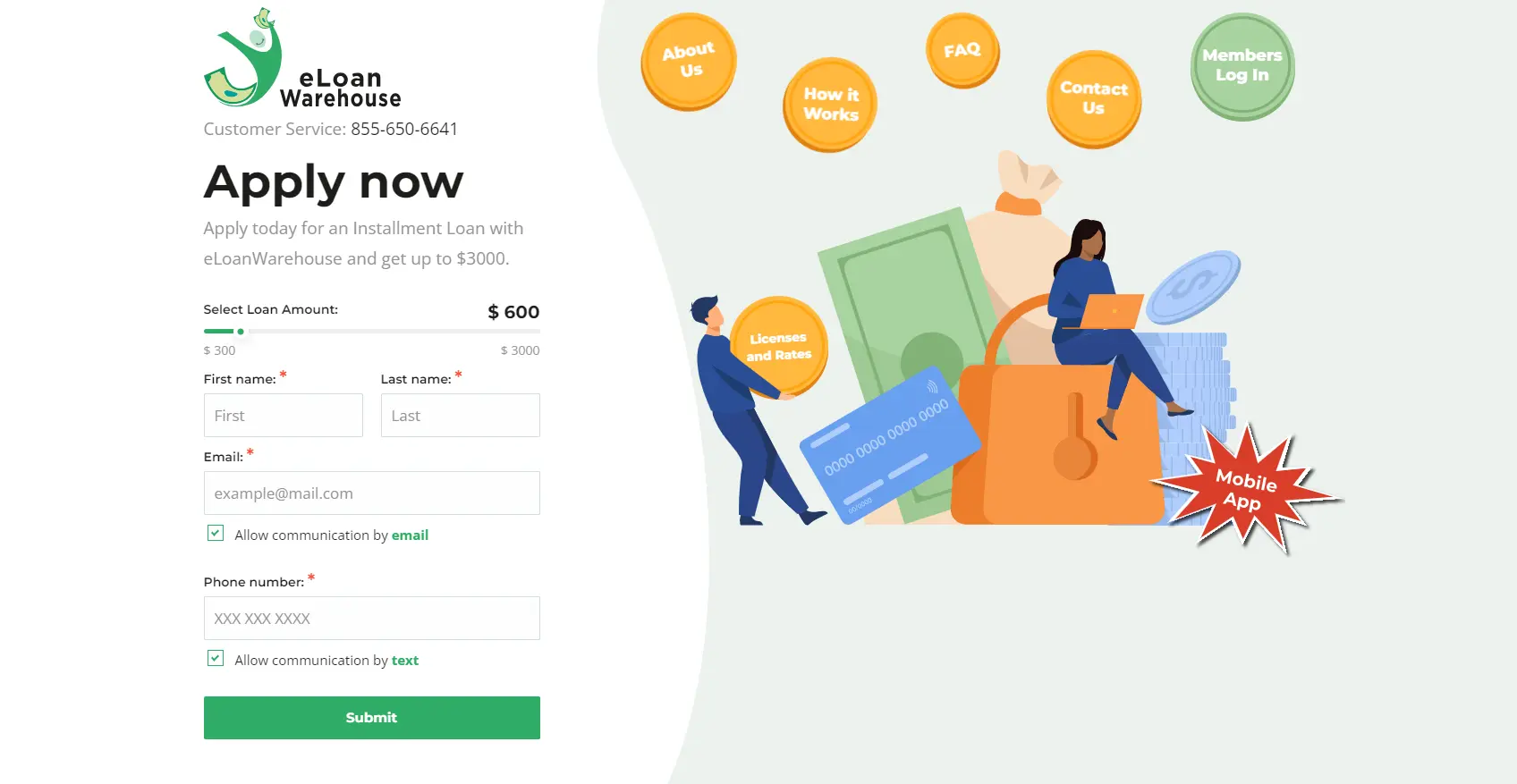

Step 1: Visit the eLoanWarehouse Website

The first step is to go directly to the eLoanWarehouse website. You’ll notice right away that the site is designed to be user-friendly. Everything you need is clearly laid out, so you won’t have to hunt around for the application form. I appreciated how clean and simple the site was, especially since I was already stressed about needing money quickly.

Step 2: Fill Out the Online Application

Once you’re on the website, you’ll find an “Apply Now” button prominently displayed. Click on it to start your application. The form will ask for basic personal information—things like your name, address, and phone number. You’ll also need to provide details about your employment, including your job title and monthly income.

The application process took me just a few minutes, and the questions were straightforward. You’ll also need to provide your banking information, such as your checking account number and routing number. This is necessary for eLoanWarehouse to deposit your funds and set up automatic repayments. Make sure you double-check this information to avoid any delays.

Step 3: Review the Loan Terms

Before you submit your application, take a moment to review the loan terms. eLoanWarehouse lays out the interest rates, fees, and repayment schedule in clear terms, so you’ll know exactly what you’re agreeing to. I found this transparency reassuring—it’s always a good idea to know what you’re getting into before you commit.

This step is critical because once you submit your application, you’re agreeing to the terms and conditions. If anything seems unclear, don’t hesitate to reach out to their customer service for clarification. It’s better to ask questions now than to be surprised later.

Step 4: Submit Your Application

After reviewing the terms, go ahead and submit your application. eLoanWarehouse typically provides instant decisions, which means you’ll know right away if you’ve been approved. I remember feeling a wave of relief when my approval came through almost immediately. It was one less thing to worry about.

Step 5: Receive Your Funds

If your application is approved, the funds will be deposited directly into your checking account, usually within one business day. In my case, the money was there the next morning, which was exactly what I needed. This quick turnaround is one of the key benefits of using eLoanWarehouse.

What to Expect After Applying?

Once you’ve received your funds, it’s important to keep track of your repayment schedule. eLoanWarehouse will set up automatic withdrawals from your checking account, so make sure the money is there when it’s time for the payment to be processed. Missing a payment can lead to additional fees, which you definitely want to avoid.

I set a reminder on my phone to make sure I didn’t forget when the payment was due. It’s a simple step, but it can save you from a lot of headaches later on. If you find yourself with extra cash before the due date, remember that you can pay off your loan early without any penalties, which can save you on interest.

Final Tips for a Smooth Application Process

Applying for a payday loan with eLoanWarehouse is simple, but there are a few tips I’d recommend to make sure everything goes smoothly:

- Double-check your information: Mistakes on your application can cause delays, so make sure everything is correct before you hit submit.

- Understand the terms: Take the time to read through the loan terms carefully. Knowing exactly what you’re agreeing to will help you avoid any surprises down the road.

- Plan for repayment: Before you even apply, have a clear plan for how you’ll repay the loan. This will help you avoid the cycle of debt that can be so easy to fall into with payday loans.

Why This Matters?

The application process might seem like just a few clicks, but it’s the first step in a financial commitment that can have significant consequences if not handled properly. By taking the time to understand each step and being prepared, you can make sure that your experience with eLoanWarehouse is as smooth and stress-free as possible.

For me, having a clear understanding of the process made all the difference. It turned what could have been a nerve-wracking experience into something manageable, and it allowed me to get the cash I needed without unnecessary complications. If you follow these steps, I’m confident you’ll find the process just as straightforward.

Conclusion

So, after diving into all the details, what’s the final word on payday loans from eLoanWarehouse? Well, I’ll say this: if you find yourself in a tight spot and need cash quickly, eLoanWarehouse can be a viable option. They offer a fast, convenient way to get funds without the hassle of a credit check, and their straightforward terms make it clear what you’re getting into.

But, as I’ve learned from personal experience, it’s crucial to approach payday loans with caution. The high interest rates and short repayment terms mean that these loans can quickly become expensive if you’re not careful. That’s why it’s so important to borrow only what you need and to have a solid plan for repayment.

For me, using eLoanWarehouse was about addressing an immediate need, and it worked well for that purpose. The process was smooth, the funds arrived quickly, and I was able to handle the emergency that had popped up. However, I made sure to pay off the loan as quickly as possible to avoid getting caught in a cycle of debt.

If you’re considering a payday loan, I’d encourage you to weigh your options carefully. There are alternatives out there—like personal loans, borrowing from friends or family, or even using a credit card—that might be less risky in the long run. But if a payday loan is your best or only option, eLoanWarehouse is a reliable platform to consider.

In the end, the key is to be informed and responsible. Understand the terms, plan for repayment, and avoid borrowing more than you can handle. If you keep these principles in mind, you can use a payday loan as a tool to navigate a financial rough patch without it becoming a long-term burden.

I hope this article has given you a clear and honest look at what payday loans from eLoanWarehouse are all about. Whether you decide to move forward with a loan or explore other options, the most important thing is to make the choice that’s right for your situation. Stay informed, stay cautious, and take control of your financial journey.